T4 - The Statement of Remuneration Paid - Box 14 explained

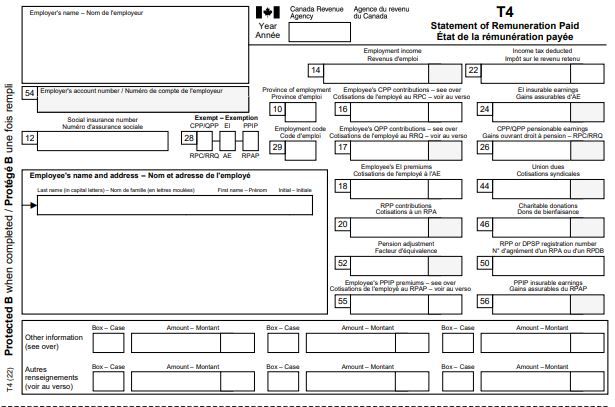

In Canada, the T4 slip, also known as the Statement of Remuneration Paid, is used to report income earned by an employee from a specific employer during a given tax year.

Box 14 on the T4 slip is used to report the total income earned by the employee during the year.

This information is used by the Canada Revenue Agency (CRA) to determine the employee's tax liability for the year.

Employers are required to provide a T4 form to each of their employees, as well as to file a summary of all T4 forms with the CRA by the end of February of the following year.

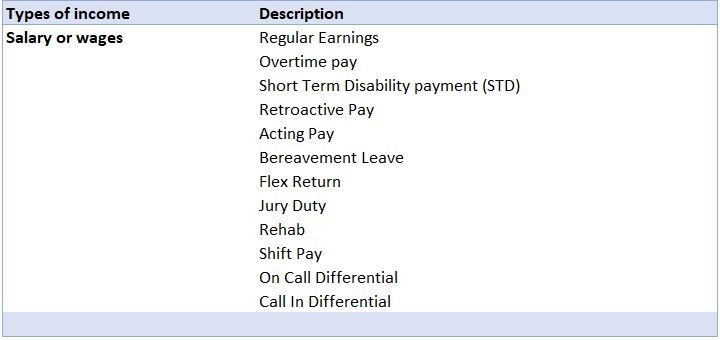

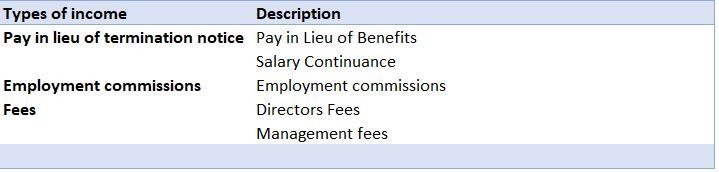

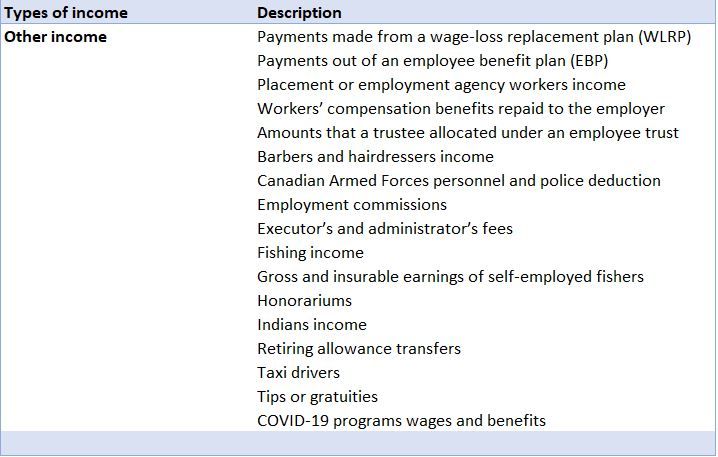

Box 14 of the T4 slip is typically used to report the following types of income:

Salary or wages:

Vacation pays and bonuses:

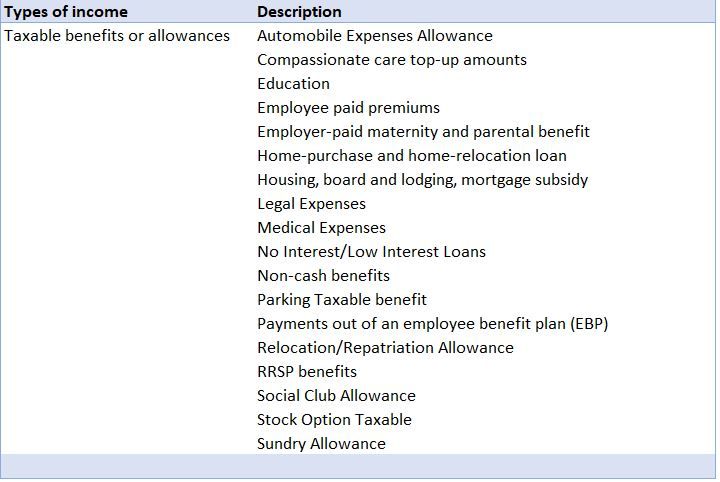

Taxable benefits or allowances:

Pay in lieu payments, employment commissions, director’s and management fees:

Other income:

It is worth noting that certain types of earnings may be subject to special rules and exceptions. For more information on this, it is recommended to consult the Canada Revenue Agency (CRA) website or contact our company for assistance.

Disclaimer:

“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation. The information is current as of the date of posting and is not intended to provide legal advice. It's always recommended that you consult with a professional accountant and lawyer for personalized guidance and advice."