Articles & Tax tips posts

My tax-related tips posts are articles and tutorials that provide helpful guidance and advice and educate Canadian taxpayers on how to save money and maximaze their tax deductions and credits and to provide dips and trategies for reducing tax liability.

I am providing resources and information for small business owners and self-employed individuals, partnerships, corporations, students, individuals and seniors.

I would like to help taxpayers navigate the tax implications of life events such as marriage, having a child, buying a home, or starting a business.

My posts are intended to help taxpayers navigate the complex world of taxes and make the most of their tax-saving opportunities.

Articles & Tips

Tax Obligations for Teenagers in Canada: Filing Requirements and Exemptions

Discover the tax obligations teenagers face in Canada, including filing requirements and exemptions for various income sources. Gain insights on navigating their first tax return with ease.

Maximize Your Tax Benefits: Understanding Medical Expense Claims

Learn how to optimize your tax return by claiming medical expenses on Canadian tax return for yourself, your spouse, and dependents. Find more information to help you maximize your tax benefits.

Maximize Tax Savings: Understanding Eligible Dependent Criteria in Canada

Unlock tax benefits by understanding eligible dependent criteria in Canada. Maximize savings with key eligibility insights.

Prepare for the current tax season in Canada with our services, including Income Tax, Accounting, and Bookkeeping

Ensure accurate tax reporting and compliance with our comprehensive services, covering T1 Personal Tax Returns for businesses, contractors, real estate investors, individuals, non-profits, and foreign income reporting, along with T2 Corporate Tax Returns, GST Returns, T4 and T5 Filings, and Payroll…

Unlocking Tax Savings: The British Columbia Renter’s Tax Credit Explained

Great news for renters in British Columbia! Starting January 1, 2023, you can claim the new renter’s tax credit of $400. Don’t miss out on this opportunity to save on your taxes!

Most common deductions and credits

As tax season approaches, it’s advantageous to familiarize yourself with the most common deductions and credits to maximize your tax savings. The following information could prove beneficial regarding the most prevalent deductions and credits. * RRSP deduction A Registered Retirement Savings Pla…

Tax Deductibility: Interest on Unpaid Property Taxes Eligible, Penalties Not Eligible

Learn about the tax implications of overdue property taxes in Canada: While interest on unpaid property taxes is eligible for tax deduction, penalties are not. Stay informed to make the most of your deductions.

Exemption for imputed interest on short-term loans to employees

Interest-free or low-interest loans provided by the employer to employees does not qualify as a taxable benefit under these conditions: * The combined amount of all loans received doesn’t exceed $10,000 within a calendar year. * The loan(s) last for 60 days or fewer. * The loan isn’t obtained du…

New CRA Guidelines: Redefining Employer Location in Remote Work Scenarios

Starting January 1, 2024, the CRA’s updated policy on determining employer establishment for source deductions specify that an employee is considered reporting to the employer’s establishment under two conditions: 1. In cases of a ‘full-time remote work agreement,’ where the employee is reasonably…

Tax Alert: CRA Allows Deductions for Ransomware Payments!

When addressing the deductibility of costs tied to ransomware attacks and BEC (business email compromise) scams—encompassing ransom payments, payments to BEC scammers, and recovery expenses—the CRA indicated: “Expenses arising from ransomware attacks or BEC scams seem to be a prevalent risk for man…

CRA Ruling Excludes Reiki Payments from Medical Expense Tax Credit Eligibility

The CRA clarified that payments made for reiki treatments administered by reiki practitioners, involving energy guidance through hand movements over the body, won’t meet the criteria for medical expenses under s. 118.4(2)(a). This ruling is due to the absence of specific authorization for reiki prac…

Tax Obligations with CRA Extend Beyond the 6-Year Rule

If you have outstanding taxes with the CRA, the 6-year rule doesn’t exempt you. Even a decade later, you’ll still be required to settle the tax liability. Penalty and interest will continue to accrue until the outstanding tax liability is settled, emphasizing the importance of timely payment. Disc…

Employee Allowances and Reimbursements

An employee allowance refers to an extra payment given to employees regularly or as a lump sum, aside from their usual salary or wages. The aim of these allowances is to help employees cover expected job-related expenses. Calculations for allowances may depend on factors like travel distance or the…

Claiming ITCs for Pre-Partnership Construction Work through CRA’s Section 257 Rebate

Usually, if the partnership had been formed in the regular manner, it would not be eligible to claim Input Tax Credits (ITCs) for various costs incurred before its formation. However, CRA clarified that if a transfer of beneficial ownership of the land to the partnership took place during a busines…

Healthcare services subject to Goods and Services Tax (GST)

Taxable health care services (GST non exempt) Cosmetic services The exemptions for healthcare services do not cover cosmetic services or any associated supplies of property and services related to cosmetic procedures. A cosmetic service supply, as defined in the Act, refers to a property or servic…

Income generated through rentals by corporations

Income generated through rentals by corporations and governed by rules related to specified investment businesses. Active and Passive Income Operating a business through a corporation can offer long-term deferral advantages. Those who opt for this approach can benefit from the Small Business Dedu…

The acquisition by a company of Amazon cloud infrastructure services is not subject to PST

The court ruled that the purchase of Amazon cloud infrastructure services by a company is not subject to BC PST. Hootsuite, a company that offers an online social media management system to its clients, utilized Amazon Web Services (AWS) to host its platform, as it didn’t have its own servers

How to claim business expenses when there is no supporting documentation available?

The obligation to maintain books and records for at least six years Canadian small businesses can deduct business expenses under the Income Tax Act, as long as they were incurred for the purpose of earning business income. However, business owners must keep books and records for at least six years.

Restricted Stock Units (RSUs) - Tax implications for Canadian employees

RSUs, or Restricted Stock Units (also known as restricted share units), are plans that provide units to employees based on the value of the company’s shares. These units cannot be sold until specific conditions are met within a designated time period (often simply being employed by the company on th…

Repairs & maintenance of rental properties - capital expenditures vs operating expenses

The distinction between current and capital expenses carries significant tax implications for landlords who own rental properties. Why does it matter? Well, if an expense is classified as a current expense, it can be fully deducted from your rental income right away. This means that if you have a r…

CRA guidance on loans from Limited Partnerships to limited partners in Ontario

According to comments from CRA, a loan from a partnership to a general partner will be considered as a distribution. CRA stated that determining whether a payment, presented as a loan, made by a limited partnership to a limited partner should be treated as a loan or a distribution under

TFSA - active business income or passive investment income?

Be cautious when using a TFSA, as you could potentially receive a tax bill for any active business income earned within it. The Tax Court of Canada has ruled that profits from a business involving the trading of qualified investments cannot be exempted within a Tax-Free Savings Account (TFSA). Tax-…

One-time travel between home office and employer’s office is not taxable

According to the CRA’s findings, traveling between a home office and the employer’s office on a one-time basis is considered part of one’s job duties, and the employer’s office could be considered a designated work location. New employees who were hired by the employer for a 24-month period work fr…

Poker professional players: tax implications of income - two case studies

The Tax Court of Canada has ruled recently in two separate cases that playing poker on a full-time basis and utilizing skill and risk-reduction strategies qualifies as a source of income for taxpayers. In one case (Bérubé), the taxpayer deposited all his savings with an online poker site and began

Understanding the CRA’s change-in-use rules for crypto miners

The CRA has stated as a result of the legislative change, made in 2021 but effective May 18, 2019, the change-in-use rules would typically apply to the capital properties of cryptocurrency miners. Prior to this date, the CRA considered miners to be engaged in commercial activity. Miners were requi…

Tax-Free Motor Vehicle Allowances

As per the Income Tax Act, employers can reimburse employees or officers (corporation directors) for business-related travel expenses incurred while using their personal vehicle as a tax-free payment, if the motor vehicle allowance is considered reasonable. A motor vehicle allowance will be conside…

Travelling expenses explained (R. Mccullough case)

Travelling expenses As per CRA travelling expenses may include costs for food, beverages, lodging, and modes of transportation such as airplanes, trains, and buses, and can be claimed as deductions as long as the following criteria are met: • You were normally required to work away from your emplo…

Interest and penalties on late taxes

If you have an outstanding tax balance for a given year and failed to file your Canadian income tax return by April 30th, the Canada Revenue Agency will begin to impose compound daily interest starting on May 1st of that year on any remaining owed amount. It is worth mentioning

Limited Partnership

In Canada, a limited partnership (LP) is a type of business structure that combines elements of both a partnership and a corporation. These types of organization be useful for a variety of business ventures, such as real estate development, venture capital, and private equity. They are popular amon…

Canadian Mortgage/Loan Calculator - free Microsoft Excel template

This Excel Canadian mortgage calculator allows you to determine the payment and remaining balance for a mortgage based on various input parameters such as the term, additional unscheduled payments, compounding period, and payment frequency. In some cases interest may be tax-deductable (for example…

Personal use of company assets

When examining private corporations, we frequently come across a prevalent mistake: possessing personal use assets as corporate assets. Shareholders may assume that buying assets within the corporation is tax-efficient. However, utilizing corporate property for personal purposes by a shareholder is…

CRA: Tax interpretations

NEWS: CRA indicates circumscribed acceptance of using average exchange rates For purposes of determining a taxpayer’s income, the CRA will generally accept the use of an average exchange rate over a given period of time (e.g., annual, quarterly or monthly) to convert amounts arising from foreign cu…

Taxpayer’s appeal for allowed Motor Vehicle expenses in the Tax Court of Canada

In 2016, the Canada Revenue Agency reassessed taxpayer and disallowed the motor vehicle expenses she claimed for the 2015 tax year. When she filed her 2015 income tax return, she had claimed $12,868 in motor vehicle expenses under section 8(1)(h.1) of the Income Tax Act. At

Non-cash compensation to family members - a court ruling Aprile v. R (2005 TCC 216) explained.

Providing compensation to family members in forms other than cash may be considered acceptable. Although paying salaries or wages via cheques or electronic transfers is the most simplest and straightforward way to maintain documentation and record-keeping, a court ruling in the case of Aprile v. R…

Tuition fees for private schools - tax deductions and credits

Private school fees can be a significant financial burden for families. However, certain tax deductions and credits are available for parents who pay private school tuition fees in Canada. In this context, we will explore the tax benefits associated with private school tuition fees, including the…

90-day timeframe for filing a notice of objection

What steps to take when a tax client disputes with the Canada Revenue Agency (CRA) In the event of disagreement with an income tax assessment, a taxpayer have 90 days to file a Notice of Objection. If this deadline is not met, the taxpayer lose the right to appeal without

Cryptocurrency - Tax Implications explained

The following cryptocurrency are recognized as taxable assets in Canada: Bitcoin Ethereum Solana XRP The CRA recognizes that cryptocurrency uses blockchain technology which creates a permanent and indelible record of all transactions, reducing the need for financial institutions to verify tran…

Limitations on expenses for vehicles used by passengers

Under the Income Tax Act, there are restrictions on the allowable deductions for passenger vehicles, whether new or used, except for zero-emission vehicles (ZEVs) purchased before March 2, 2020, which must be new. The prescribed limits for passenger vehicles acquired or leased after 2000 are as foll…

Reasonable compensation to spouse or children

In Canada, reasonable salaries paid to a spouse or children as part of a business operation are deductible business expenses for income tax purposes.

Interest on funds borrowed for investment purposes

The interest on the loan taken to purchase investments can be deductible if the investments generate income in the form of dividends or interest, or if there is a reasonable expectation that they will generate income. This deduction can be made from the total income. Please note that the interest

Lottery Winnings Gift Tax

Canada does not impose a tax on gifts, allowing gifts of any kind, including winnings from lotteries, can be given without facing tax consequences. For example, if a family member wins a lottery and chooses to give the winnings as a gift, the recipient will not be taxed on what

Medical expense tax credit for hair transplant costs

Expenses for hair transplant surgery paid to a medical doctor are typically eligible for a tax credit under Canadian Income Tax when the doctor evaluates the patient prior to the procedure and views it as part of the patient’s mental health treatment. According to paragraph 118.2(2)(a) of

The spouse with the lower income should claim all medical expenses on their tax return

The lower-income spouse should report all the family’s medical expenses for Canadian Income Tax. The less your net income, the higher the amount of eligible medical expenses you can claim. However, since the tax credit is non-refundable, the spouse claiming the credit should have enough income to u…

Revenue from renting out a room in your primary home

If you earn incidental income from renting out a room in your primary residence, the property will remain exempt from Canadian income tax on any capital gain upon sale, as long as: * no structural changes are made * capital cost allowance (depreciation) is not claimed Disclaimer:“Please note t…

Guidelines for the Cancellation and Waiver of Interest and Penalties

This document outlines the procedure for requesting the cancellation or waiver of interest and penalties, as well as the necessary information needed for the request to be evaluated. Penalties and interest may be waived or cancelled in whole or in part where they result in circumstances beyond a ta…

Tax advantages of setting a trust for new immigrants

Proper pre-arrival planning can enable new permanent residents in Canada to significantly lower or eliminate their Canadian taxes. This can be achieved by establishing an offshore trust to protect non-Canadian income and capital gains for up to five years after moving to Canada. Within this tax-fr…

Not eligible medical expenses

The list below details the medical expenses that cannot be claimed as tax deductions in Canada. List of common medical expenses: Disclaimer:“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation. The information is cu…

Income sharing through transfer of funds to a minor child

Reducing family’s overall Canadian income tax liability can be achieved by transferring funds to a minor child. The capital gain earned from this transfer will be reported on the child’s tax return, instead of the parent’s, if the child earns the capital gain and not interest or dividends.

Medical expenses that doesn’t have to be prescribed by a licensed medical professional

The following is a list of medical expenses that doesn’t have to be medically prescribed in order to be tax-deductible in Canada. List of common medical expenses: Disclaimer:“Please note that the information provided in this article is of a general nature and may not be accurate for your specifi…

Medical expenses that must be prescribed by a licensed medical professional

The following is a list of medical expenses that must be medically prescribed in order to be tax-deductible in Canada. List of common medical expenses: Disclaimer:“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation…

Deducting rent expenses for a home-based corporation

If you operate your business from your home, you may charge rent for the portion of your home used for work purposes. These expenses may include: property taxes, utilities such as gas, water, and electricity, interest, home insurance, general repairs and maintenance. When you charge rent to y…

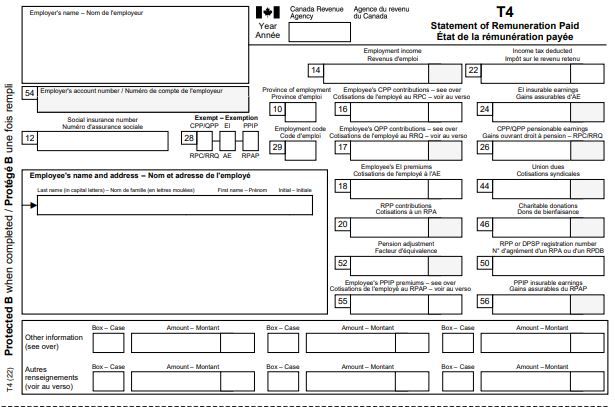

T4 - The Statement of Remuneration Paid - Box 14 explained

In Canada, the T4 slip, also known as the Statement of Remuneration Paid, is used to report income earned by an employee from a specific employer during a given tax year. Box 14 on the T4 slip is used to report the total income earned by the employee during the

Real Estate Property disposition rules prior ceasing residency in Canada

If you intend to emigrate from Canada and sell your house, it is advisable to complete the sale while you remain a resident, so that you can claim the principal residence exemption and avoid paying taxes on the resulting capital gain. Non-resident owner of a principal residence in Canada A

Filing due dates for self-employed

Due dates for self-employed individuals to file their taxes: * relating mostly to a tax shelter investment, your tax reporting return must be filed by April 30; * other than those relating mostly to a tax shelter investment, your tax reporting return must be filed by June 15. If there is a

Employment Expenses - transportation employees

You may be able to claim the cost of meals and lodging (including showers) if you are an employee of a transport business, a railway employee, or other transport employee. This cost includes any GST and provincial sales tax, or HST, you paid on these expenses. You may be able

How To Cancel GST/HST Account

In order to terminate your GST account, you need to complete form RC145 - Request to Close Business Number (BN) Accounts - provided by the CRA. The completed form can be either mailed or faxed to your tax services office. There are a few things you need to be aware

Where to mail your paper T1 return

Filing online File online for free - Free certified software products are available to file your income tax and benefit return online. Resident individuals: Tax centre mailing address for resident individuals for their tax return Non-residentindividuals: Disclaimer:“Please note that the inform…

The tax-deductibility of expenses related to childcare expenses for after-school activities.

Expenses related to childcare for after-school activities may be tax-deductible in certain circumstances, as established by a court ruling in the case of Kwan v. The Queen (2018 TCC 184) and I will provide more information about this case in the following section. The taxpayer appealed from a reass…

Parking Taxable Benefit

As per the guidelines of the Canada Revenue Agency, the provision of parking by an employer to an employee is considered a taxable benefit. The amount of the taxable benefit is calculated by subtracting any payment made by the employee for the use of the parking space from the fair

Canadian Small Businesses guide - expenses

Business expenses are costs incurred for the purpose of generating income in a business, and should be supported by documentation such as invoices, receipts, or vouchers. It’s important to obtain these records, especially when paying in cash. Please keep in mind that all expenses should be related t…

Canadian Payroll

As an employer, it is necessary to deduct a portion of your employees’ remuneration on a regular basis. You qualify as an employer if you provide your employees with salaries, wages (including advances), bonuses, vacation pay, or tips, or offer certain taxable benefits or allowances like board and…

Changing or Amending Your Tax Return

Canadian Tax, Payroll and Accounting, Ms Excel support, analytics, controls, audits

The application of GST on parking tickets

If the parking lot is a commercial parking space then parking is subject to GST/HST. In the case of a public service body (PSB) parking lot, it may be exempt from GST/HST, which means it may not be included. To determine whether GST/HST is included in the

The tax implications of borrowing for business investment

As a business owner, you may need to borrow funds for different purposes such as injecting capital, buying capital assets, or refinancing debt. The aim of this article is to address frequently asked questions about the deductibility of interest for incorporated business owners. It’s important to un…

Securities transactions: the traditional test of income vs. capital account classification

Traditional test used by the courts to distinguish between securities transactions on income account and those on capital account: The elements of the traditional test include: (a) frequency of transactions; (b) period of ownership; (c) knowledge of securities markets; (d) security transactions…

Business definition for ITA

The Act does not provide a general definition of a “business” but does include specific activities in the extended non-exhaustive definition of “business” in subsection 248(1). In particular, subsection 248(1) extends the meaning of “business” to include: a profession, calling, trade, manufacture…

PST - Small Seller

What defines a small seller? You are a small seller if you meet all of the following criteria: ■ you are located in BC but do not maintain established business premises and do not regularly make retail sales from established commercial premises (see Established Commercial Premises or Established B…

Discontinuing operations of a business

In case you are shutting down an unincorporated business, certain actions must be taken. However, the details provided below do not cover all aspects of business closure, therefore seeking expert assistance is recommended. Payroll In case you had hired employees, it is mandatory to submit all pay…

Summary of important dates for businesses

Running a business involves more than just making sales and generating revenue. It also requires staying on top of various dates and deadlines throughout the year. From tax deadlines to payroll remittance due dates, missing important dates can result in penalties and fees. As such, it is crucial fo…

Maintaining documentation of Crypto Currency

The Canada Revenue Agency (CRA) has recognized that digital currencies such as Bitcoin, Ethereum, Solona, and Ripple (XRP) are taxable assets, given that they are based on blockchain technology. This technology features a permanent and unalterable ledger that documents and stores all cryptocurrency…

House resold by renovator within a year, leads to capital gain

One year of purchasing and reselling a house by a renovator resulted in a capital gain. A taxpayer and a friend purchased a Montreal house with the intention of renovating it and renting it out. However, due to rising renovation costs and inability to rent it out, they resold it

Airfares incurred for commuting to work cannot be claimed as deductible expenses

The Tax Court of Canada ruled that airfares for commuting to work were not an allowable deduction as employment expenses. The Tax Court of Canada ruled that the taxpayer’s commuter airfares between his Ottawa home and his employer’s Regina office were not tax-deductible. The taxpayer regularly com…

Register for a GST/HST account

Generally, you will need to register for your business number (BN) before you can register for a GST/HST account. You may register for a BN by using the online service at Business Registration Online. This is the quickest way to register for a BN. Once you have obtained your

Bitcoin mining involves a barter exchange of services for bitcoin

Bitcoin mining is treated by the CRA as a barter exchange involving services in exchange for bitcoin. CRA considers bitcoin mining as a barter exchange and requires miners to report as income either the value of the services rendered or the value of bitcoin received, whichever is more easily valued…

Free parking pass is a taxable benefit, despite employer’s business benefits

The Federal Court of Appeal ruled that a parking pass provided free of charge to an employee was subject to taxation, even though it had benefits for the employer’s business. The judge stated that despite the employer’s belief that providing a parking pass to flight attendants enhanced their reliab…

Employee home office expenses cannot include property taxes or insurance

In general, expenses related to an employee’s home office cannot include property taxes or insurance. CRA previously indicated that property taxes and home insurance costs associated with maintaining an employee’s home office may be included in their expenses, except for commission employees under…

Principal residence is determined by the time and personal connection

The B.C. Supreme Court ruled that a Calgary executive who owned a large home in British Columbia had his “principal place of residence” in B.C. The individual in question, who was identified as a wealthy CEO of an international energy company, maintained a 600 square foot apartment within

The absence of receipts for expenses covered by the employer can lead to a taxable benefit

The CRA determined that the monthly payments made to cover the costs of employed bus drivers were taxable since no receipts were required. The CRA determined that the fixed monthly payments made to school bus drivers to cover the following personal costs: ■ cellular phone usage, ■ bus washing exp…

CRA notes that the travel allowance exemption in s. 6(6)(b)(i) does not include travel from a “temporary” place of residence

the CRA provided a “question of fact” response regarding whether travel allowances given to employees of auditing firms for their travel to and from audited premises during two-week audit engagements are taxable, depending on whether the client premises are considered “regular places of employment.”…

The CRA refuses to offer assurance that travel allowances given to employees of accounting firms for their audit-related travel are exempt from taxes.

Is it necessary for employees of auditing firms to pay taxes on travel allowances they receive for traveling between their home and the audited premises during audit engagements that typically last for two weeks? The CRA referred to its previous statement in T4130, which defined a “regular place of…

CRA indicates that the penalty for late-filing information slips references when the last slip was filed

The penalty under s. 162(7.01) for late-filing most types of information slip (e.g., the T3, T4, T4A, T5, NR4 or T4RSP) is calculated under a formula which references the number of late-filed slips and “the number of days, not exceeding 100, during which the failure continues.” CRA

CRA issues a clearance certificate before a corporate dissolution

CRA will issue a single s. 159(2) certificate to the first-named legal representative, but will include all other representatives’ names on the certificate and send copies to other addresses if provided. A corporation does not have to be dissolved before requesting a clearance certificate, and a pa…

The deduction for meals and entertainment expenses for commissioned employees is limited to 25%

When commissioned employees take a client out to eat in their home city, they are only allowed to deduct 25% of the restaurant bill. The deduction for commissioned employees taking clients to a restaurant within their employer’s metropolitan area is limited to 25% of the bill due to the combined

Uninhabited renovated residences may not be eligible for the principal residence exemption

The Court of Quebec ruled that a couple, who renovated a house but did not move in, did not qualify for the principal residence exemption. Two individuals bought a dilapidated house in Montreal for $695,000 and spent $350,000 on substantial renovations. Seven months after buying the property, they

Tax court rules no mark-up on shareholder work results in taxable benefit

The Tax Court of Canada ruled that a house construction company’s decision not to charge a mark-up on the costs incurred for shareholder work resulted in a taxable benefit. The sole shareholder of a home construction company oversaw the building of his own residence and repaid the company for all

A free parking spot provided for non-business usage is viewed as a taxable benefit

According to the CRA, a free parking spot is considered a taxable benefit at fair market value, unless there is “regular” business usage. The CRA acknowledges that a free parking spot provided to an employee for business purposes does not result in a taxable benefit, but only if the employee’s

CRA allows employees to buy merchandise at cost

CRA previously stated that discounts on merchandise received by employees due to their employment are generally taxable as a benefit. The value of the benefit is equal to the fair market value of the merchandise purchased, less the amount paid by the employee, unless the discount is also available t…

Personal services business exclusion - independence, control, provision of own tools, and flexible hours

Court of Quebec finds that incorporated repairman was not carrying on a personal services business due to factors such as independence from agency control, provision of own tools, and flexible hours. A foreman-supervised incorporated repairman was found by the Court of Quebec to not be engaged in a…

Cell phone expenses of an employee deemed tax-deductible

The Tax Court permitted an employee to deduct cell phone expenses as a cost of supplies consumed directly in the performance of work duties. This ruling is particularly noteworthy as the employee was able to claim the deduction despite lacking proper records for the expenses. An employee, who worke…

Tax deductible clothing

The Tax Court of Canada ruled that expenses incurred by an actor for clothing used in promotions were not tax deductible. The judge ruled that the expenses claimed by a teenage actor for clothing, which he argued were necessary to maintain his image for auditions and promotional appearances, were n…

Non-severable piece of land cannot have two different beneficial owners for the primary residence and business sections

It is not possible for a non-severable piece of land to have two different beneficial owners for the primary residence and business sections. The owner of a non-severable farming land wishes to transfer the farming section of the property to a corporation that they wholly own, while maintaining ben…

Board and lodging costs for logging workers may be not tax deductable

Employees working remotely at a logging site were unable to subtract their expenses for lodging and meals from their logs. The logging workers commuted from their residences to a forest camp, where they were provided with room and board and then transported to the logging site on a daily basis.

Active airline employees are subject to taxable benefits for utilizing airline passes

Utilizing confirmed space passes, but not standby passes, by airline staff constitutes a taxable benefit. The Canada Revenue Agency (CRA) has verified that the use of confirmed space airline passes, excluding standby passes, by active airline employees is considered a taxable benefit, valued at the…

Ontario introduces a “Non-Resident Speculation Tax”

The Ontario Ministry of Finance has released a summary of its proposed 15% tax on foreign real estate purchasers. The principal announced features are: * The 15% tax applies effective April 21, 2017 to the value of consideration for the transfer (including a beneficial transfer only) of a resident…

Deduction limits and car expenses for the year 2016

The regulations regarding automobile expenses and the amount that can be claimed or deducted are subject to annual changes. As such, Canadian tax planning for automobile expenses must be reviewed and updated each year. For 2016, the income tax exempt car allowance limit paid by Canadian employers…