Repairs & maintenance of rental properties - capital expenditures vs operating expenses

Learn how to differentiate between capital expenditures and operating expenses for rental properties to optimize your tax strategy.

The distinction between current and capital expenses carries significant tax implications for landlords who own rental properties.

Why does it matter? Categorized as a current expense, an expenditure can be entirely deducted from your rental income immediately, allowing you to offset your other income sources and potentially receive a tax refund if your rental income is in a loss. Conversely, if an expense is classified as a capital expense, it cannot be immediately claimed by the taxpayer and cannot be written off right away.

Expenses must be reasonable and justifiable based on the circumstances, with consideration given to whether they were incurred to generate income or increase property value, their proportion, any subsequent cost reductions or unexpected cost increases.

It is not always evident to distinguish between a capital and a current expenses. Nowhere in the Act or Regulations are “capital expenditure” or “operating expense” clearly defined.

Depending on circumstances, the same expenditure can be classified as either capital or current, and the decision can only be made after considering all relevant facts related to whether the expense was incurred for income or capital purposes. For example replacing a "door" can be classified as a repair. However, it may also be considered a capital expenditure if, for instance, the replacement of the door is part of a larger set of repairs that leads to the complete reconstruction or rehabilitation of the structure.

If you are uncertain about distinguishing between capital and operational expenses, refer to tables below to determine whether the expense is classified as capital or current.

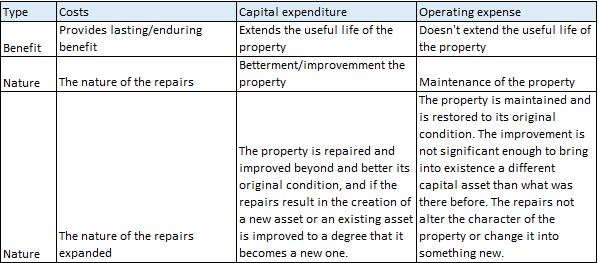

First refer to the table below and respond to the queries under the categories of capital and current expenses, taking into account the type of benefit and the nature of the repairs.

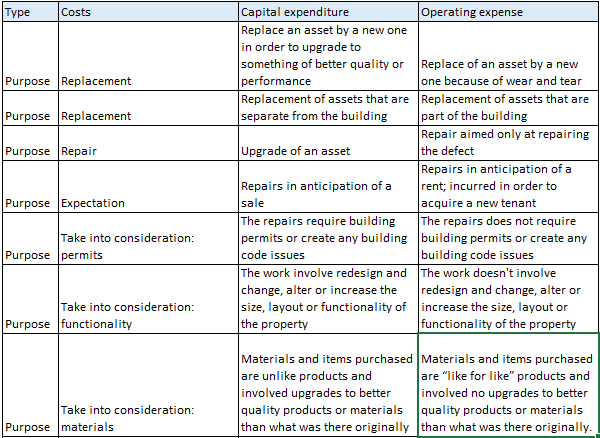

Next, contemplate examining the purpose of the repairs:

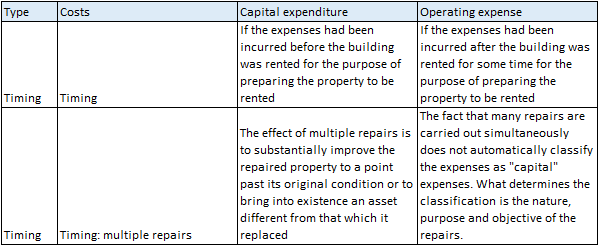

Then, consider examining the timing of the repairs:

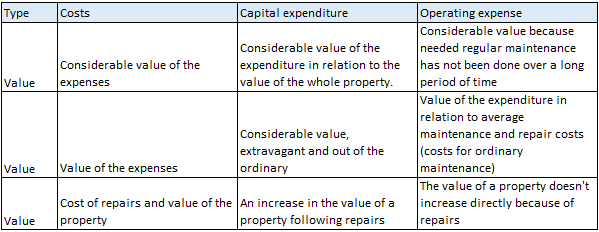

Then, consider examining the value of the repairs:

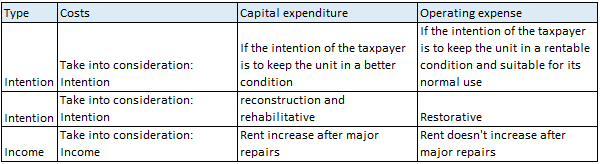

Then, consider examining the intention of the repairs and compare the future income with the income before making repairs:

Please utilize the provided Excel template which includes a range of factors to consider, to determine whether the expenses for renovation and repairs should be classified as current or capital.

The template comprises a variety of factors to contemplate.

It can be beneficial to examine real-life instances, so please refer to the examples below of repairs that are classified as either current or capital.

Make sure to consider all the factors discussed in this article.

Operating expenses examples:

- Major repairs of hurricane damages and damages caused by a tenant that not improve a house beyond its original condition;

- Replacing a 20-year-old deck at a cost of $8k which is for example 3.1% of the total cost of the property;

- Returning a roof to its original condition or replacing a worn-out roof with a roof of similar materials;

- Repairs in the amount of $30k to put a duplex purchased for $419k back to original state;

- Replacing part of a parking garage roof with a longer lasting one;

- Replacing worn out and outdated kitchen cabinets;

- Wiring, plumbing, hot water tanks;

- Replaced fixtures such as toilets and sinks, i.e., because of wear and tear;

- Painting the interior or exterior of a house.

Capital expenditure examples:

- Work to change the use of premises or a room or to add new premises or a new room is usually capital in nature;

- A change in the heating system;

- Significant renovations undertaken to ready a property for rental that was in poor condition;

- Replacing wood framed windows with vinyl framed;

- Putting vinyl siding on the exterior of a wooden or stucco house;

- Replacing wooden steps with concrete ones;

- Replaced fixtures such as toilets and sinks, i.e., in order to upgrade to something of better quality or performance, not because of wear and tear;

- Used property requiring repairs at time of acquisition to put it in suitable condition;

- Purchase capital assets like: refrigerators, stoves, compressors;

- Repairs and renovations to reconstruct a building and create an asset of enduring nature.

Get in touch with me to discover strategies for optimizing your tax savings @ 604-727-1540

Disclaimer:

“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation. The information is current as of the date of posting and is not intended to provide legal advice. It's always recommended that you consult with a professional accountant and lawyer for personalized guidance and advice."