Limited Partnership

In Canada, a limited partnership (LP) is a type of business structure that combines elements of both a partnership and a corporation.

These types of organization be useful for a variety of business ventures, such as real estate development, venture capital, and private equity. They are popular among entrepreneurs involved in IT industries, such as IT service providers, web designers, and similar businesses. They can also be used as a way for investors to invest in a business without taking on personal liability for its debts and obligations.

Benefits of establishing a limited partnership:

There are several benefits to establishing a limited partnership in Canada, including:

Limited Liability: Limited partners are only liable for the partnership's debts and obligations to the extent of their capital contributions. This means that they are not personally liable for partnership debts or obligations beyond the amount of their capital contributions.

Personal assets are protected from lawsuits for limited partners.

Flexibility: Limited partnerships are flexible and can be structured to suit the specific needs of the partners. The partnership agreement can be customized to address the specific needs of the partners.

Raising Capital: Limited partnerships can be used to raise capital from a large number of investors.

Specialization: Limited partners can contribute money, property, or specialized skills to the partnership while general partners manage the day-to-day operations.

Continuity: Limited partnerships have perpetual existence, meaning the partnership continues even if a partner dies or withdraws.

Legal structure:

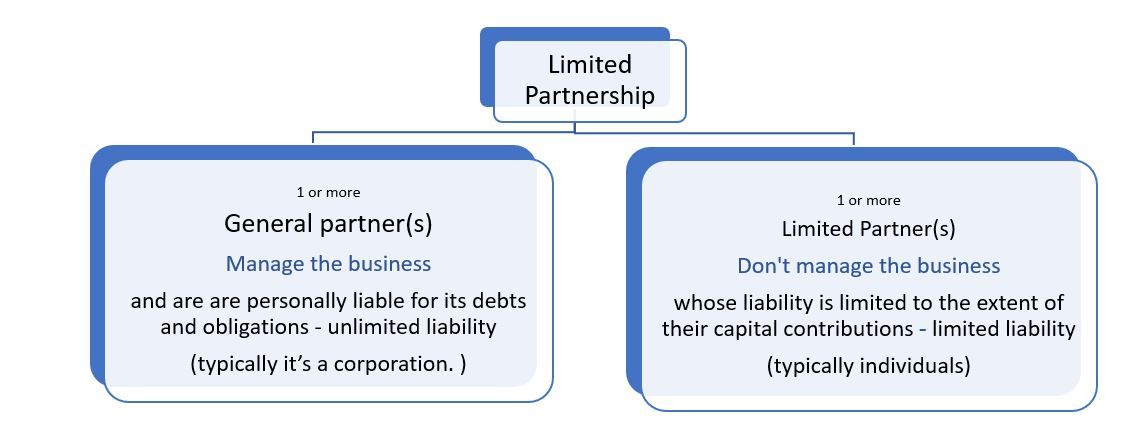

Limited partnership (LP) is composed as following:

Limited partnerships in Canada are governed by the relevant provincial or territorial partnership legislation, and the terms of the partnership agreement.

It's also worth noting that, Limited Partnerships are considered as passive investment vehicle, therefore the limited partners won't be considered as active business owners, and as a result, they don't have the same level of control over the partnership's operations as general partners do. Limited partners cannot engage in activities that would be considered to be "taking part in the management" of the partnership, as doing so would result in the loss of limited liability protection.

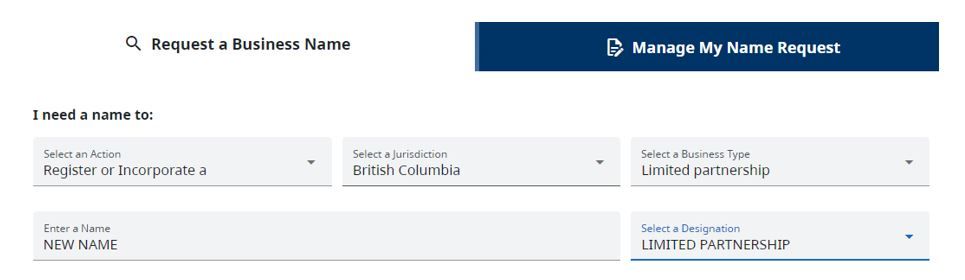

Registration:

To establish a limited partnership in Canada, a registration process must be completed with the relevant provincial or territorial government. To establish LP in British Columbia you need to follow the steps:

1) Submit a request with the British Columbia Registry Services to register a Limited Partnership business name

2) Submit a request with the British Columbia Registry Services to register a corporation business name

3) After both requests are processed and names are secured, submit a request to incorporate

4) After the request to incorporate is processed, submit a request to register the limited partnership with the relevant government agency. File a Limited Partnership Declaration, along with the required forms and payment (such as cheque) to the agency's specified address.

Keep in mind, that a declaration of limited partnership expires five years after its date of filing unless the existing Declaration is replaced by filing a new Declaration before the expiry date.

Please contact us if you need any help with the registration process.

Taxation and tax return obligations:

Limited Partnership(s)

A limited partnership is not considered a separate legal entity for tax purposes and does not file its own tax return and does not pay income taxes. Limited partnerships considered flow-through entities, which means that income and losses flow through the partnership to the partners in accordance with the terms of the LP agreement and are allocated among the partners and reported on their individual tax returns.

Limited partnership is required to file a partnership information return (T5013) each year, regardless of whether or not it has any income. The partnership information return is a tax form that is used to report the income, gains, losses, and other information of the partnership to the Canada Revenue Agency (CRA). The partnership information return is a summary of the partnership's financial activity and does not replace the partners' individual tax returns.

Limited partner(s):

On personal tax return each partner must report their share of the partnership's income or loss on their individual tax return, and claim deductions and credits associated with their share of the partnership's expenses. Limited partners are considered passive investors and the general partner provides them with the necessary information slips (T5013, Schedule 3, Statement of Partnership Income) to report their income.

General partner(s):

General Partner(corporation): A general partner that is a corporation will be required to file a T2 Corporate Income Tax return. The T2 return is used to report the income, gains, losses, and deductions of the corporation for a particular tax year. The general partner corporation will also be responsible for paying income tax on its income, and it will be required to file T2 Corporate Income Tax return

Accounting for limited partnership:

Like a general partnership, a limited partnership must maintain accurate financial records and prepare financial statements, including an income statement, balance sheet, and statement of changes in partners' equity.

Limited partnership must also maintain records of each partner's capital account, which shows the partner's initial capital contribution, any additional contributions, and their share of the partnership's profits and losses.

The financial statements for a limited partnership with a corporate general partner and individual limited partners should consists of:

-

Income Statement: This statement will show the partnership's revenues and expenses for a given period

-

Balance Sheet: This statement will show the partnership's assets, liabilities, and equity at a specific point in time. It will include the following sections:

Assets: This section will show the partnership's assets, such as cash, accounts receivable, and property.

Liabilities: This section will show the partnership's liabilities

Equity: This section will show the partnership's equity, which is the difference between assets and liabilities. It will include the following:

Capital Account:

Capital Contributions: This section will show the initial capital contributions made by each partner, as well as any additional contributions made during the year.

Partner's Share of Income (or Loss): This section will show each partner's share of the partnership's net income or loss for the period.

Distributions: This section will show any distributions made to the partners during the period.

If you require any help or assistance with filing tax returns for your Limited Partnership, please reach out to us.

Disclaimer:

“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation. The information is current as of the date of posting and is not intended to provide legal advice. It's always recommended that you consult with a professional accountant and lawyer for personalized guidance and advice."

Get in touch with me to discover strategies for optimizing your tax savings @ 604-727-1540