Guidelines for the Cancellation and Waiver of Interest and Penalties

This document outlines the procedure for requesting the cancellation or waiver of interest and penalties, as well as the necessary information needed for the request to be evaluated.

Penalties and interest may be waived or cancelled in whole or in part where they result in circumstances beyond a taxpayer's or employer's control.

For example, exceptional circumstances may have prevented a taxpayer, their representative, the executor of an estate, or an employer from making a payment on time, such as:

- natural or human-made disasters such as, flood or fire;

- civil disturbances or disruptions in services such as, a postal strike;

- a serious illness or accident; or

- serious emotional or mental distress such as, death in the immediate family.

Cancelling or waiving interest or penalties may also be appropriate if the interest or penalty arose primarily because of actions of the Department, such as:

- processing delays which result in the taxpayer not being informed, within a reasonable time, that an amount was owing;

- material available to the public contained errors which led taxpayers to file returns or make payments based on incorrect information;

- a taxpayer or employer receives incorrect advice such as in the case where the Department wrongly advises a taxpayer that no instalment payments will be required for the current year;

- errors in processing; or

- delays in providing information such as the case where the taxpayer could not make the appropriate instalment or arrears payments because the necessary information was not available.

- undue delays in resolving an objection or an appeal, or in completing an audit

It may be appropriate, in circumstances where there is an inability to pay amounts owing, to consider waiving or cancelling interest in all or in part to facilitate collection. For example

- when collection has been suspended due to an inability to pay for example caused by the loss of employment and the taxpayer is experiencing financial hardship

- when a taxpayer is unable to conclude a reasonable payment arrangement because the interest charges absorb a significant portion of the payments. In such a case, consideration may be given to waiving interest in all or in part for the period from when payments commence until the amounts owing are paid provided the agreed payments are made on time.

- payment of the accumulated interest would cause a prolonged inability to provide basic necessities (financial hardship) such as food, medical help, transportation, or shelter; consideration may be given to cancelling all or part of the total accumulated interest

Requests for cancelling or waiving interest and penalties

The best way to submit your request is online.

• Individuals or their representatives can apply online through My Account or Represent a Client by:

- using the "Request relief of penalties and interest" service; or

- filling out Form RC4288, Request for Taxpayer Relief - Cancel or Waive Penalties or Interest and selecting the "Submit documents" service.

Businesses or their representatives can apply online through My Business Account, or Represent a Client by:

- using the "Request relief of penalties and interest" service; or

- filling out Form RC4288, Request for Taxpayer Relief - Cancel or Waive Penalties or Interest and selecting the "Submit documents" service.

Taxpayers and employers, or their authorized representatives, can make their requests by writing to the taxation centre where they file their returns, or by sending their requests to the district office serving their area.

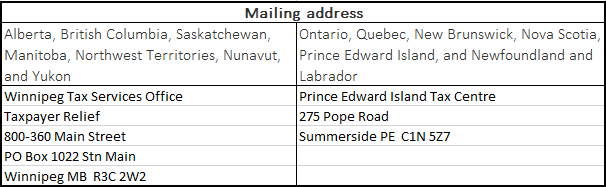

Designated offices:

To support a request, the following information is required:

- the name, address, telephone number, social insurance number or account number of the taxpayer or employer (for example business number (BN))

- the taxation years (fiscal period(s)) involved;

- the facts and reasons why the interest or penalties levied, or to be levied, were primarily caused by factors beyond the taxpayer's control; an explanation of how the circumstances affected your ability to meet your tax obligations;

- the facts and reasons supporting your inability to pay the penalties or interest assessed or charged, or to be assessed or charged;

- any relevant documents or correspondence including receipts of payment.

- in cases involving an inability to pay or financial hardship, full financial disclosure including a statement of income, expenses, assets, and liabilities

- supporting details of incorrect information given by the CRA in the form of written answers, published information, other evidence; or when the incorrect information given by the CRA is of a verbal nature, you should give all possible details such as date, time, name of CRA official spoken to, and details of the conversation; or

- a complete history of events including any measures that have been taken, e.g., payments and payment arrangements, and when they were taken to resolve the non-compliance.

The following factors will be considered when determining whether or not the Department will cancel or waive interest or penalties:

- whether or not the taxpayer or employer has a history of compliance with tax obligations;

- whether or not the taxpayer or employer has knowingly allowed a balance to exist upon which arrears interest has accrued;

- whether or not the taxpayer or employer has exercised a reasonable amount of care and has not been negligent or careless in conducting their affairs under the self-assessment system;

- whether or not the taxpayer or employer has acted quickly to remedy any delay or omission.

After the CRA receives your request

The CRA administers various legislations that give the Minister of National Revenue the discretion to:

• cancel or waive penalties and interest

• accept certain late, amended, or revoked income tax elections

• refund or make an adjustment to refund or reduce the amount payable beyond the normal three-year period for an individual, a graduated rate estate, and for certain tax years, a testamentary trust

Objections and appeals

A taxpayer cannot file an objection or appeal where the request to waive or cancel interest or penalties has not or has only been partially granted except for taxation years within the normal reassessment period.

Disclaimer:

“Please note that the information provided in this article is of a general nature and may not be accurate for your specific situation. The information is current as of the date of posting and is not intended to provide legal advice. It's always recommended that you consult with a professional accountant and lawyer for personalized guidance and advice."